About Service and Package Charges

What is a service charge?

A service charge is a means of passing on operational costs or automatic gratuities to the client. A service charge can be a tip, fee, or Ticket Charge.

- Tips are gratuities that go towards the servicing employee or House. These can be an amount or a percentage of the service cost.

- Fees are amounts collected by the business to cover operational costs, employee training, etc. These can be an amount or a percentage of the service cost.

- A Ticket Charge is a service charge that can be applied once per ticket. These can only be configured as an amount.

Are service charges applied to Cancellation Fees?

Yes, service charges are applied to Cancellation Fees by default. To remove service charges from a Cancellation Fee, apply a manually discount or edit the Cancellation Fee to remove the service charge.

What is a package charge?

A package charge is a type of service charge specifically for packages. In terms of how they work in Meevo, package charges are identical to service charges except that package charges are configured in the Packages data maintenance form. Package charges are not available for membership packages, and they are ignored for packages that are accrued via a membership.

Throughout Meevo Help, references to "service charges" include package charges unless stated otherwise.

How do service charge data items work in a multi-location business model?

Service charges can be created in Central Office and pushed down to locations. From a location's perspective, only the service charge amount can be edited on a CO-owned service charge. Additionally, a location can add location-owned services to a CO-owned service charge, but a location cannot add or remove any CO-owned services.

Can a service be assigned several service charges?

Yes! There are no limitations to how many service charges a service can be assigned to.

Can I apply several service charges on the same transaction?

Yes! The same Employee Fee/Tip or House Fee/Tip charge will appear for every associated service on the Smart Receipt. The exception to this is a Ticket Charge. Each individual Ticket Charge can only be applied once per transaction, regardless of how many associated services are on the ticket. However, you can apply several separately configured Ticket Charges to the same transaction.

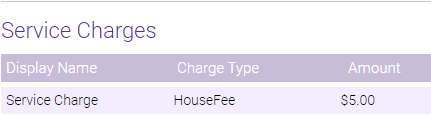

Aside from the Service Charges data maintenance form, where else can I view configured service charges?

At the bottom of a Service definition's Main tab, there is a read-only section that lists all service charges that are assigned to that service.

Do service charges appear as separate line items?

With the exclusion of Ticket Charges, all other service charges are not broken out as separate line items on client-facing prices, including on receipts. Service prices that appear in the Appointment Editor, Register, Online Booking, and eGift are inclusive of configured Service Charges.

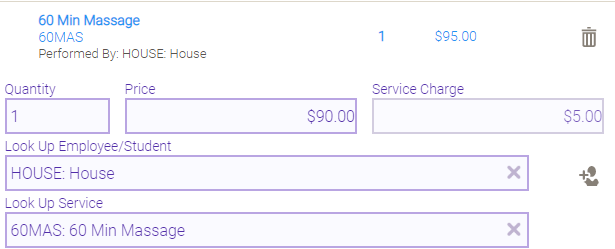

In the Meevo register, you can select a service line item in the Smart Receipt to see a breakdown of any service charges being applied.

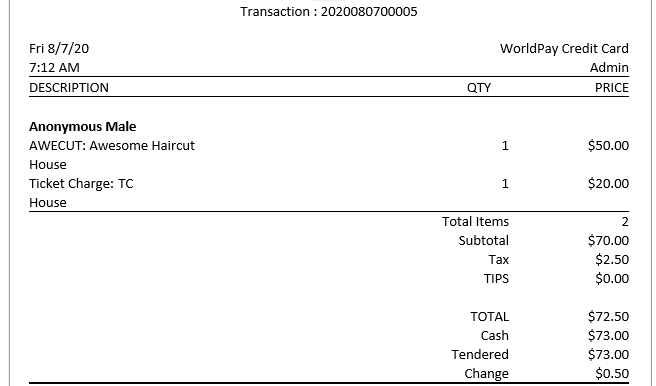

Ticket Charges, however, do appear as separate line items.

- The Smart Receipt:

- Client-facing receipts:

Note: In the QuickBooks integration, Service and Package Charges are sub-accounts of the Other Income account.

Are there any situations in which a service charge is not applied to a configured service?

A service charge will not be applied to a service if:

- The service is being redeemed from a package. Service charges are not considered when calculating the redemption value of a service from the package, either.

- The service is selected as part of a "manual" refund.

How do service charges affect tips and employee commission?

With the exception of Ticket Charges, all other service charges are included in tip percentage calculations, but are not broken out as a separate tip in the register's tip modal. For example, if an employee is performing a $90 service with a $5 service charge, the tip percentage will be based on the full $95.

In the case of Ticket Charges, these are not included in tip calculations. For example, if an employee is performing a $90 service with a $5 Ticket Charge, the tip percentage will be based on $90.

Service charges are not included as part of an employee's commissionable amount. For example, if an employee is performing a $90 service with a $5 service charge, the cost to the client will be $95, but the employee's commissionable amount will be the price of the service ($90).

How do service charges affect discounts?

Service charges are not included in pre-discount calculations.

- If the service charge is configured as a percentage, that percentage is calculated after the discount is applied to the original price. For example, on a $70 service, the client receives a 20% discount and 10% service charge:

20% off $70 = $56, and 10% of $56 = $5.60. So the final price: $56 + $5.60 = $61.60.

- If the service charge is configured as an amount, the amount is added to the post-discount price. For example, on a $70 service, client receives a 20% discount and $10 service charge:

20% off $70 = $56, so the final price: $56 + $10 = $66.00.

How do service charges affect refunds?

With historical refunds, the full amount is refunded, including any service charges. Package charges are included in the refund, proportional to the price paid for the package.

With manual refunds, no service charges are applied.

How do service charges appear in Transaction Editor?

Total Service Charges for a transaction are aggregated and displayed as a single line item for the transaction, similar to how discounts are displayed.

Do service charges appear in any reports?

Yes! Service Charges will appear in reports, in Transaction Editor, and in closing totals. Service Charges will be displayed on the following reports:

- DE044: Employee Commission Overrides: When the Service Charge is configured as an Employee Tip.

- DE040: Employee Payroll: When the Service Charge is configured as an Employee Tip.

- MR200: Employee Sales: When the Service Charge is configured as a House Tip or Employee Tip.

- DE070: Tips Collected: When the Service Charge is configured as a House Tip or Employee Tip.

- MR080: Register Summary: All Service Charges appear here, whether configured as a fee or tip.

- MR095: Sales Tax Collected: If charges were configured with tax, the collected tax is accounted for in the MR095.