Setting Up Work Activity Overrides

How do Work Activities impact payroll?

Whether a Work Activity is Paid and/or requires clock-in are important factors into how payroll is calculated for an employee.

- If any paid Work Activity has a clock-in, but there is no clock-out, those hours are omitted from payroll (Meevo always takes actual hours over scheduled hours). It does not matter whether or not the Work Activity was set to Must Clock In. Any time there is a clock-in for any Work Activity, there must also be a clock-out for Meevo to include those hours in payroll.

- If a Work Activity is Paid and marked as Must Clock In, employees will not be paid for their scheduled hours unless they have a clock in and a clock out.

- If a Work Activity is Paid and not marked as Must Clock In:

- Meevo will first look for any actual hours that may be in the system as a result of employee clock ins and clock outs. If there are no actuals to use, Meevo then looks at the scheduled hours for payroll calculations.

- Keep in mind that employees will be paid for any Work Activity that they clock in for in addition to their scheduled hours. So, if an employee is scheduled for paid Work Activity A that does not require clock-in, but the employee instead clocks in for Work Activity B during this time, the employee will be paid for both: the Work Activity A scheduled hours + Work Activity B actual hours.

- If an hourly employee works two different Work Activities with two different rates in the same payroll period, Meevo uses a blended rate to calculate those earnings. Read on for more details on blended rates.

What is a blended rate and how is it calculated?

If an hourly employee has at least two Work Activities with different rates in the same payroll period, Meevo uses a blended rate calculation to determine earnings. The blended rate calculation divides the sum of each Work Activity's earnings by the total number of hours worked during the work week:

[(Work Activity A hours x Work Activity A rate) + (Work Activity B hours x Work Activity B rate)] / (Work Activity A hours + Work Activity B hours)

Meevo then multiplies the blended rate by the number of hours worked:

- For regular hours: Blended rate x Regular hours for the week

- For overtime: (Overtime multiplier x Blended rate) x Overtime hours for the week

- Finally, Meevo adds regular and overtime pay to determine total earnings for the week.

For example, let's assume an employee worked 55 hours in a given week, and overtime is paid out weekly for anything over 40 hours:

Work Activity A: 35 hours @$15/hr = $525

Work Activity B: 20 hours @$12.50/hr = $250

The blended rate would be calculated as:

($525 + $250) / 55 hrs = $14.09 blended rate

- Regular hours: $14.09 x 40 hours regular time = $563.60

- Overtime hours: ($14.09 x 1.5 multiplier) x 15 hours overtime = $317.03

- Total earnings for the week: $563.60 regular pay + $317.03 overtime pay = $880.63 earnings

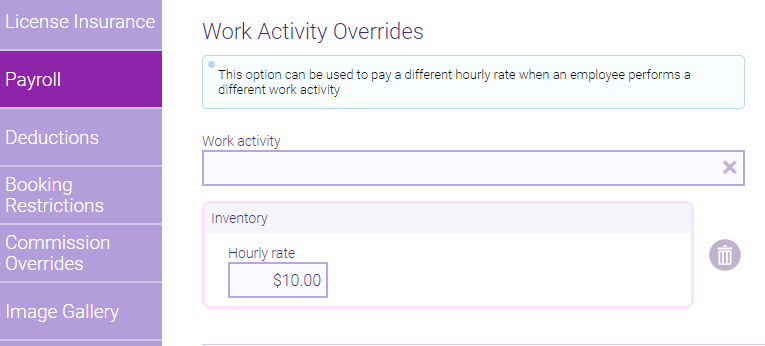

Work Activity Overrides

Work Activity Overrides are configured from the Payroll tab of the employee's profile. These overrides can be used to pay a different hourly rate when the employee performs that specific Work Activity.

Work activity: Select a Work Activity and specify an Hourly rate. Depending on how the employee's pay is set up, the employee may receive this hourly rate when scheduled for the selected Work Activity.