Setting Up Employee Deductions

To get here, go to Meevo > Data > Employees and select the Deductions tab.

Note: Be sure to review our Understanding Deductions topic before you proceed.

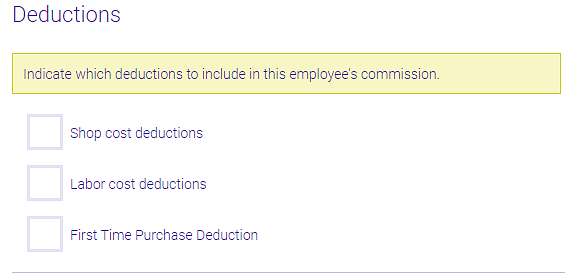

Deductions

In this section, you are enabling the deductions to include in this employee's commission. The actual Shop, Labor, and First Time Purchase deduction amounts can be defined via a service definition or an employee profile.

- After you've defined your deduction amounts, the next step is to enable those deductions for each employee in the Deductions tab of the employee profile. This must be done for the employee to receive the configured deductions. Select each desired option to enable the corresponding service- or employee-level deductions.

- Shop Costs: Shop costs may include product and equipment usage.

- Labor Costs: Labor costs may include assistants and similar staff.

- First time Purchase Deduction: First time purchase deductions help offset marketing and advertising costs that are associated with obtaining new clients. The First Time Purchase Deduction is applied if it is the first time an employee is performing this service on this client within this location. Note that the first-time purchase deduction is calculated overnight, not in real-time.

- Ben performs a haircut on Tanya in Location A, and it is the first time Ben has ever performed this service on Tanya. Ben will incur a First Time Purchase Deduction.

- Four weeks later, Ben performs that same haircut on Tanya in Location A. Ben will not incur a First Time Purchase Deduction, as that charge was incurred in a above.

- Five weeks later, Ben, who is a multi-location employee, performs that same haircut on Tanya, but at a different location. Ben will incur a First Time Purchase Deduction, as this is the first time he's performed that service on Tanya at that location.

- Five weeks later, Ben performs a haircut and color on Tanya in Location A, and it is the first time Ben has ever performed a color on Tanya. Ben will incur a First Time Purchase Deduction for the color, but not the haircut, as the haircut charge was incurred in a above.

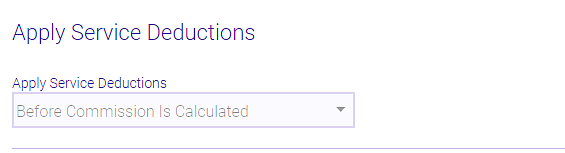

- Next, configure when those deduction should be applied: Before Commission Is Calculated or After Commission Is Calculated.

- Before Commission is Calculated

Service Price – Deductions = New Service Price

New Service Price x Employee Commission % = Total Employee Service Commission - After Commission is Calculated

Service Price x Employee Service Commission % = Employee Service Commission

Employee Service Commission - Deductions = Total Employee Service Commission

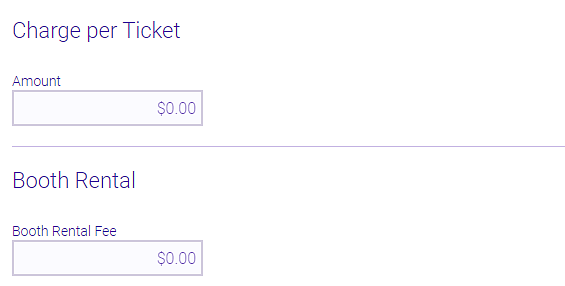

- Finally, configure the Charge per Ticket and Booth Rental Fee, if any.

- Charge per Ticket: Charge per Ticket is a flat amount that is deducted per ticket, before or after commission is calculated depending on what is set in the Apply Service Deductions field.

- Booth Rental Fee: This deduction is per payroll period, and it is the very last deduction from the employee's actual service commission.

- When finished, select Save.

- The actual Shop, Labor, and First Time Purchase deduction amounts can be defined in two areas of Meevo:

- When amounts are defined in a service definition, any employee who performs that service and who has the corresponding deduction enabled in their profile (via step 1) has that deduction applied.

- When amounts are defined in an employee profile as a deduction override, those amounts are deducted from that specific employee when they perform that specific service. This deduction amount overrides the deduction amount on the service definition, if any.