Splitting Commissions

Splitting commission on a sale ensures that everyone involved is fairly compensated. For example, you may want to split commission when multiple staff members collaborate on a service, or when one team member recommends a product or service to a client and another closes on the sale.

Splitting commission during a transaction

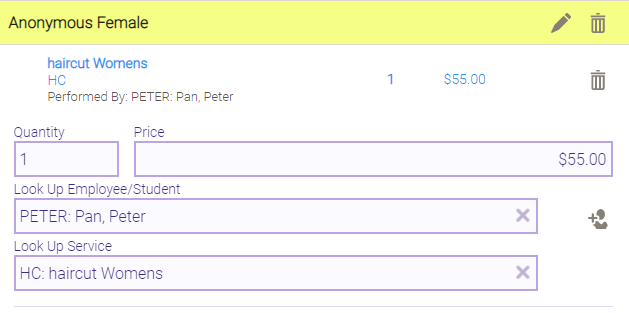

In the Smart Receipt, you can enable sharing of commissions with one other employee. The steps below assume the Smart Receipt is already populated with a client, sale item, and employee credited with the sale.

- Select the sale item to reveal additional options.

- Beside the Look Up Employee field, select Split Commission.

- In the right pane, select the other employee with whom the commission will be shared.

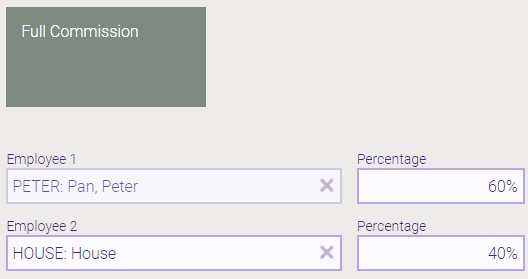

- Define the commission split using percentages:

- Percentage: Enter the percentage of the commission that each employee will receive. The other field auto-populates with a value so that both equal 100%.

- Full Commission: Select this tile for each employee to receive 100% of their configured commission.

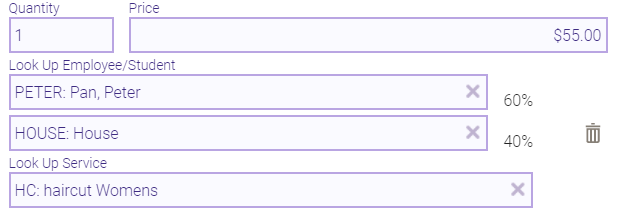

- When finished, select Apply. The Smart Receipt updates with the new commission percentages.

Splitting commission on a completed transaction

To split commission on a completed transaction:

- Go Meevo > Register > Transaction Editor.

- Locate the transaction in Transaction Editor.

- Select Edit Transaction beside the transaction and make your changes:

- Select Split Commission.

- Add the additional employee and adjust each percentage appropriately.

- Be sure to Save the updated transactions when finished.

Note: If splitting commission with House, the employee's name must be selected first, as the primary service provider, and then House can be added as the secondary.

How commission splits impact payroll deductions

When you split commission on a sale item between two employees, it can alter how Meevo calculates payroll deductions:

- When a deduction is configured as a percentage (whether an employee-specific deduction override or a standard amount), that percentage is applied to what the employee's commissionable amount is after the split.

- Deductions that are configured as flat amounts are treated slightly differently. For these deductions, the employee's split percentage is applied to the configured deduction (employee-specific deduction override or standard amount) to determine the actual deduction.

For example, let's assume an employee received 60% split commission on a $100 service. The employee's deductions are configured for a 2% Labor Cost and $1 Shop Cost.

- 60% split on a $100 service = $60 commissionable amount

- 2% Labor Cost on $60 commissionable amount = $1.20 Labor Cost deduction

- Since the $1 Shop Cost is a flat rate, we apply the employee's 60% commission percentage to the $1 Shop Cost = $0.60

- Total deductions for this employee are $1.20 + $0.60 = $1.80