DE040: Employee Payroll

The DE040 report displays payroll calculations by employee for the selected payroll periods. Summary View displays total pay calculations, while Detail View displays a complete breakdown of each calculation.

Tips on using the DE040

- Run the DE040 report after each payroll period ends to assist with processing payroll. It is important to run this report at least one day after the payroll period ends to ensure accurate reporting.

- If change have been made to commission, a transaction, or an employee's schedule, be sure to reprocess any Previous payrolls in order to see these changes reflected in the DE040.

- It is not recommended to compare MR200 sales data with DE040 sales data. The MR200 uses the final price that the client paid at the register, while the DE040 uses the employee's commissionable amount, regardless of what the client paid at the register.

Report definitions

- Salary: The salary for the current payroll period. If the employee is set to:

- Salary and Commission: The higher of Salary per payroll OR earnings from Base hourly rate is added to the Service Commission.

- Salary or Commission: The higher of Salary per payroll OR earnings from Base hourly rate is compared against the Service Commission. Whichever is higher will be displayed.

- Commission Only: The report displays zero, as there is no salary to report.

- Hours: The total number of Actual Hours worked, before overtime.

- Over 8, Over 12, Over 40, 7th Day, 7th Day Over 8: Overtime hours worked. These fields are included only if Advanced Overtime is set up.

- Regular Wage: Total wages or salary earned from pre-OT hours.

- O.T. Wage: Total wages earned from Overtime hours.

- Total Wage: The total wage that the employee earned, calculated as (Regular Wage + OT Wage).

- Total Srv. Hours: Number of service hours worked, based on the start and end time of the appointments. If no appointment was booked, Meevo uses employee-specific timing for that service. If no employee-specific timing exists, then Meevo uses the service definition step timing. Clean Up steps do not count towards this metric, nor do services that were cancelled or no-showed.

- # Srv. Performed: The number of services that were performed.

- (Services) Sales: Total service sales, accounting for refunds.

- (Services) Deduction: Total deductions from service sales, accounting for refunds. Booth Rental Fee deductions are excluded from this calculation, as they appear elsewhere in the report.

- Ticket Charge: Total Per Ticket deductions.

- (Services) Comm: Total service commission earned based on employee commission scales and employee/service commission overrides.

- (Retail) Sales: Total of retail sales, accounting for refunds.

- (Retail) Comm: Total retail commission earned based on employee commission scales.

- Retail to Service: Total retail to service commission earned based on employee's retail to service commission scales.

- PKG Sales: Total of package sales, accounting for refunds.

- PKG Comm.: Total package commission earned based on employee commission scales and commission overrides.

- Mem Sales: Total of membership sales, accounting for refunds.

- Mem. Comm.: Total membership commission earned based on employee commission scales and commission overrides.

- Booth Rental Fee: Total amount owed by that employee on booth renter fees (per payroll period) as defined in the employee's profile > Deductions tab.

- Tips: Total amount earned on tips, including Service Charges that are configured as Employee Tip. This appears if Display Tips was selected in report setup.

- Total (far right column): Total Wage + Commission columns + Retail To Service + Tips - Booth Rental Fee

- Total (bottom row): The sum of the values in the Total for Period row.

Wage Calculation section

- Paid Work Activities: Paid Work Activities that the employee was scheduled for. Hours are calculated according to the scheduled Work Activity, unless there are actuals, in which case the clock-in/out hours are used. If Advanced Overtime is set up, those values appear here as well.

- Unpaid Work Activities: Unpaid Work Activities that the employee was scheduled for. Hours are calculated according to the schedule, unless there are actuals, in which case the clock-in/out hours are used.

- Wage Calculation: Employee wage according to the employee's payroll settings.

Service Commission section

Service Sales w/ No Commission Overrides subsection

- Base Service Commissionable Amount (Refunds Incl.): Total commissionable amount of service sales that did not have a commission override, accounting for refunds.

- # Srv. Performed: Total number of services that were performed.

- Total Srv. Hours: Number of service hours worked, based on the start and end time of the appointments. If no appointment was booked, Meevo uses employee-specific timing for that service. If no employee-specific timing exists, then Meevo uses the service definition step timing. Clean Up steps do not count towards this metric, nor do services that were cancelled or no-showed.

- Deductions: Total amount of deductions (Shop Cost, Labor Cost, First Time Purchase) on sales that don't have commission overrides.

- Appt. Type Overrides: Commission override adjustments due to the appointment being a Redo, Walk-in, Requested, or New Client.

- Service Comm. Calculation Based On: The amount that the service commission will be based on, including the scale type and what is used.

- Commission on Service Sales w/ No Overrides: Total commission earned on service sales that have no commission overrides.

Service Sales w/ Commission Overrides subsection

- Base Service Commissionable Amount (Refunds Incl.): Total commissionable amount of service sales that the employee was credited with that have commission overrides. This total cannot be included in commission scales since the override determines the commissionable amount.

With % Commission Overrides subsection

- Base Service Commission w/ % Override Amount (Refunds Incl.): Total commissionable amount of service sales whose override was a percentage, accounting for refunds.

- Deductions: Total amount of deductions (Shop Cost, Labor Cost, First Time Purchase) on sales that had a % commission override.

- Appt. Type Overrides: Commission override adjustments due to the appointment being a Redo, Walk-in, Requested, or New Client.

- Commission Awarded on Service Sales w/ % Overrides: Total commission earned on service sales that have % commission overrides.

With $ Commission Overrides subsection

- Base Service Commission w/ $ Override Amount (Refunds Incl.): Total commissionable amount of service sales whose override was a flat amount, accounting for refunds.

- Commission Awarded from $ Overrides: Total commission awarded from "flat amount" overrides.

- Appt. Type Overrides: Commission override adjustments due to the appointment being a Redo, Walk-in, Requested, or New Client.

- Commission Awarded on Service Sales w/ $ Overrides: Total commission earned on service sales that have "flat amount" commission overrides.

Commission Adjustment Information subsection

Service Sales

- Deductions: Total amount of deductions (Shop Cost, Labor Cost, First Time Purchase) on sales that don't have commission overrides.

- Appt. Type Overrides: Commission override adjustments due to the appointment being a Redo, Walk-in, Requested, or New Client on sales without a commission override.

Service Sales w/ % Commission Overrides

- Deductions: Total amount of deductions (Shop Cost, Labor Cost, First Time Purchase) on sales that have % commission overrides.

- Appt. Type Overrides: Commission override adjustments due to the appointment being a Redo, Walk-in, Requested, or New Client on sales that have % commission overrides.

Service Sales w/ $ Commission Overrides

- Appt. Type Overrides: Commission override adjustments due to the appointment being a Redo, Walk-in, or Requested, or New Client on sales that have a "flat amount" commission override.

Total section

- Commission on Service Sales w/ No Overrides: Total commission earned on service sales that have no commission overrides.

- Commission Awarded on Service Sales w/ % Overrides: Total commission earned on service sales that have % commission overrides.

- Commission Awarded on Service Sales w/ $ Overrides: Total commission earned on service sales that have "flat amount" commission overrides.

- Requested Appointment Bonus Amount: Bonuses that may come as a result of an appointment being marked as "requested."

- Per Ticket Deduction: Total deductions as a result of a "per ticket" deduction.

- Total Service Commission: The sum of the commission awarded, plus any bonus, minus any deductions.

Retail Commission section

Retail Sales w/ No Commission Overrides subsection

- Base Retail Commissionable Amount (Refunds Incl.): Total commissionable amount of retail sales that did not have a commission override, accounting for refunds.

- # Retail Items Sold: Total number of retail items that were sold.

- Commission on Retail Sales w/ No Commission Overrides: Total commission earned on retail sales that have no commission overrides.

Retail Sales w/ Commission Overrides subsection

- Base Service Commissionable Amount (Refunds Incl.): Total commissionable amount of retail sales that the employee was credited with that have commission overrides. This total cannot be included in commission scales since the override determines the commissionable amount.

- Retail Commission Awarded from % Overrides: Total commission earned on retail sales that have % commission overrides.

- Retail Commission Awarded from $ Overrides: Total commission earned on retail sales that have "flat amount" commission overrides.

Total section

- Commission on Retail Sales w/ No Overrides: Total commission earned on retail sales that have no commission overrides.

- Retail Commission Awarded from % Overrides: Total commission earned on retail sales that have % commission overrides.

- Retail Commission Awarded from $ Overrides: Total commission earned on retail sales that have "flat amount" commission overrides.

- Total Retail Commission: The sum of all retail commission.

Retail to Service Commission Bonus section

- Retail Sales: Total retail sales, accounting for refunds.

- Service Sales: Total service sales, accounting for refunds.

- Retail to Service Percentage: (Retail Sales / Service Sales) x 100

- Scales Used: This is the Retail to Service Percentage according to the employee's Payroll settings.

- Bonus Awarded: Retail Sales x Scales Used Percentage

Package Commission section

Package Sales w/ No Commission Overrides subsection

- Base Pkg Commissionable Amount (Refunds Incl.): Total commissionable amount of package sales that did not have a commission override, accounting for refunds.

- # Pkgs Sold: Total number of packages that were sold.

- Pkg Commission Awarded: Total commission earned on package sales that have no commission overrides.

Pkg Sales w/ Commission Overrides subsection

- Base Service Commissionable Amount (Refunds Incl.): Total commissionable amount of package sales that the employee was credited with that have commission overrides. This total cannot be included in commission scales since the override determines the commissionable amount.

- Pkg. Commission Awarded from % Overrides: Total commission earned on package sales that have % commission overrides.

- Pkg. Commission Awarded from $ Overrides: Total commission earned on package sales that have "flat amount" commission overrides.

Total section

- Pkg Commission Awarded: Total commission earned on package sales that have no commission overrides.

- Pkg. Commission Awarded from % Overrides: Total commission earned on package sales that have % commission overrides.

- Pkg. Commission Awarded from % Overrides: Total commission earned on package sales that have "flat amount" commission overrides.

- SPIFFS Awarded (Refunds Incl.): Total Spiff awarded, accounting for any refunds.

- Total Pkg. Commission: The sum of all package commission, including Spiffs.

Membership Commission section

Enrollment Fee Calculation w/ No Overrides subsection

- Base Mem. Commissionable Amount (Refunds Incl.): Total commissionable amount of membership sales that did not have a commission override, accounting for refunds.

- # Membership Sold: Total number of memberships that were sold.

- Mem Commission Awarded: Commission earned on membership sales that have no commission overrides.

- Commission on Enrollment Fee Calculation w/ No Overrides: Total commission earned on membership sales that have no commission overrides.

Enrollment Fee Calculation w/ Commission Overrides subsection

- Base Service Commissionable Amount (Refunds Incl.): Total commissionable amount of membership sales that the employee was credited with that have commission overrides.

- Membership Commission Awarded from % Overrides: Total commission earned on membership sales that have % commission overrides.

- Membership Commission Awarded from $ Overrides: Total commission earned on membership sales that have "flat amount" commission overrides.

Enrollment Fee Subtotal subsection

- Commission on Enrollment Fee Calculation w/ No Overrides: Total commission earned on membership sales that have no commission overrides.

- Membership Commission Awarded from % Overrides: Total commission earned on membership sales that have % commission overrides.

- Membership Commission Awarded from $ Overrides: Total commission earned on membership sales that have "flat amount" commission overrides.

Recurring Fee Calculation w/ No Overrides subsection

- Base Mem. Commissionable Amount (Refunds Incl.): Total commissionable amount of recurring fees that did not have a commission override, accounting for refunds.

- # Recurring Fees Collected: Total number of membership recurring fees that were collected.

- Recurring Fee Commission Awarded: Commission earned on recurring fees that have no commission overrides.

- Commission on Recurring Fees w/ No Overrides: Total commission earned on recurring fees that have no commission overrides.

Recurring Fee Calculation w/ Commission Overrides subsection

- Base Service Commissionable Amount (Refunds Incl.): Total commissionable amount of recurring fees that the employee was credited with that have commission overrides. This total cannot be included in commission scales since the override determines the commissionable amount.

- Recurring Fee Commission Awarded from % Overrides: Total commission earned on recurring fees that have % commission overrides.

- Recurring Fee Commission Awarded from $ Overrides: Total commission earned on recurring fees that have "flat amount" commission overrides.

Recurring Fee Subtotal subsection

- Commission on Recurring Fees w/ No Overrides: Total commission earned on membership recurring fees that have no commission overrides.

- Recurring Fee Commission Awarded from % Overrides: Total commission earned on recurring fees that have % commission overrides.

- Recurring Fee Commission Awarded from $ Overrides: Total commission earned on recurring fees that have "flat amount" commission overrides.

- Membership Recurring Fee Commission: Sum of all membership recurring fee commissions.

Total subsection

- Membership Enrollment Fee Commission: Total commission earned on membership enrollment fees.

- Membership Recurring Fee Commission: Total commission earned on membership recurring fees.

- Total Membership Commission: (Enrollment Fee Commission + Recurring Fee Commission)

Commission Totals section

On the left, we list Wage and Service Commission. Depending on an employee's payroll setting (Employee Pay Calculation option), the report will use either Wage or Service Commission and indicate which is being used.

- Wage Commission: Total from Wage Calculation subsection.

- Service Commission: The Service Commission Total.

- Wages and/or Service Commission: What appears here depends on the Employee Pay Calculation payroll option.

- Retail, Retail to Service, Membership, Package Commission: These are the totals taken from previous sections and subsections of the report.

- Gross Commission: The sum of all commissions from all other sections.

- Booth Rental Fee: The Booth Rental Fee as defined in the employee profile > Deductions tab.

- Total Earnings for Date Range: All totals added up, subtracting the Booth Rental Fee.

- Tips Collected for Date Range: Tips that were collected in the date range, including Service Charges that are configured as Employee Tip.

When Multi-Location Payroll is enabled, running the DE040 in Summary View from an employee's Home Location will display the employee's payroll data from all locations. Detail View continues to provide payroll data from this location only.

If running the DE040 from a location that is not an employee's Home Location, the report displays the employee's payroll data from that location only.

Setting up the DE040 report

- Type DE040 in the Convobar, or go to Meevo > Reports > Payroll, and then select the DE040 report.

- Choose which mode to run the report in: Detail View or Summary View.

- Identify Employees By: Displays employees by name or by Employee Number, either of which is referenced directly from the employee's profile.

- Display Tips: Includes tip data in the report, including Service Charges that are configured as Employee Tip.

- Display Weekly Breakdowns (Summary View only): When selected, the report displays a breakdown of calculations by week. When it's not selected, only totals are displayed.

- View Payroll Data For: Select whether to run this report for one payroll period or multiple payroll periods.

- One Payroll Period: Select a Payroll Year and Payroll Period to report on. Each payroll period will be labeled with an S (service payroll), R (retail payroll), or SR (service and retail payroll).

- Multiple Payroll Periods: Use the date pickers to specify a date range. The report will pull in payrolls whose Start Date falls within the date range selected here. For reference, you can select View Periods to see your payroll period start and end dates.

-

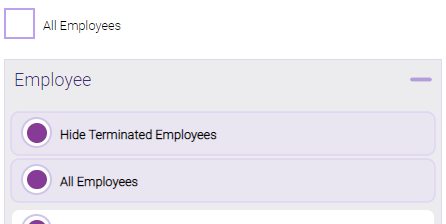

All Employees: Enable this checkbox to run the report for all employees within the date range. This includes active, inactive (including terminated), and deleted employees. Or, to run the report for specific employees, deselect the checkbox and use the drop-down to select employees or Employee Categories. You can show or hide inactive employees in this list, but deleted employees will never appear here. Note the All Employees "bubble" in the Employee list selects all employees in that list; it is not the equivalent of selecting the All Employees checkbox.

Running the report

- When you are ready to generate the report, select a Report Format beside the Run Report button.

- Here is a rundown of each format type:

- PDF: Each time you select Run Report with PDF selected, Meevo opens a separate browser tab that displays the PDF'ed report. Meevo remains on the setup page, so you can quickly jump back over to Meevo to run more date ranges or other reports. Each PDF report you run will open its own browser tab, so you can easily review and compare reports by simply jumping between browser tabs.

- HTML: This is our original legacy format, which opens the report within Meevo. All of the functionality within that report is still there and available via the toolbar.

- XLSX: Each time you select Run Report, your browser auto-downloads the report in .xlsx format. Select the downloaded file in the browser footer to open the spreadsheet.

- Select Run Report to generate the report in your chosen format. Depending on the type of report and criteria you entered, this process may take a few minutes.