Setting Up Employee Deduction Overrides

Deduction overrides define how much is deducted when a specific service is performed by a specific employee.

- To get started:

- Locate and select the Employee profile. Select the Commission Overrides tab, and select Edit.

- In a service's Payroll tab, you can select Manage employee-specific __ deduction to set up your employee-level deductions. This is simply an alternative method of achieving the same result as what is described below.

- Below each desired service, select the deductions and define a value or percentage. Remember, these settings are specific to when this employee performs this service.

Note: Employee deduction calculations can be impacted if commission on an item is split between two employees. See the Splitting Commissions topic for details.

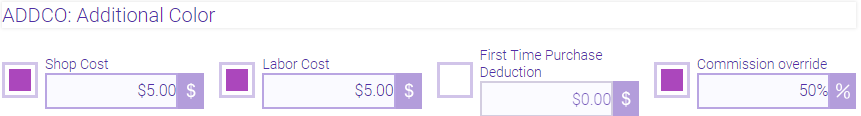

- Shop Costs: Shop costs may include product and equipment usage. Select $ or % to toggle between the two units, and enter a value.

- Labor Costs: Labor costs may include assistants and similar staff. Select $ or % to toggle between the two units, and enter a value.

- First time Purchase Deduction: First time purchase deductions help offset marketing and advertising costs that are associated with obtaining new clients. The First Time Purchase Deduction is applied if it is the first time an employee is performing this service on this client. Select $ or % to toggle between the two units, and enter a value. Note that the first-time purchase deduction is calculated overnight, not in real-time.

- Ben performs a haircut on Tanya, and it is the first time Ben has ever performed this service on Tanya. Ben will incur a First Time Purchase Deduction.

- Four weeks later, Ben performs that same haircut on Tanya. Ben will not incur a First Time Purchase Deduction, as that charge was incurred in a above.

- Five weeks later, Ben performs a haircut and color on Tanya, and it is the first time Ben has ever performed a color on Tanya. Ben will incur a First Time Purchase Deduction for the color, but not the haircut, as the haircut charge was incurred in a above.

- Commission Override: This option overrides this employee's standard commission when this service is performed; see Setting Up Commission Overrides for Individual Employees for details.

- When finished, select Save.

- Finally, make sure you enable the deductions in each employee's profile for the deductions to take effect.