Setting Up Multi-Location Payroll

Multi-Location Payroll calculates payroll data for employees who work at several locations. When Multi-Location Payroll is enabled:

- All locations run on the same payroll frequency and use the same payroll period start and end dates. The role of Central Office is to enable/disable Payroll and to configure Payroll frequency (which will be applied to all locations). Central Office cannot view or reprocess actual payrolls. Only the Payroll Settings Main tab is available to Central Office.

- The role of a location is to configure and manage the actual payroll data (view, reprocess, etc.). Locations can view Payroll frequencies, but they cannot enable/disable Payroll, nor can they edit Payroll frequencies. All additional Payroll Settings (Commission Detail, Split Commissions, and Clock In/Out Rules tabs) are configured at the location level and are only available to locations.

- If your payroll is off, you can edit these payroll settings up until the night before the Pay Period Start date.

- If you are editing settings for existing payroll that is already on, you have until midnight of the current day to make changes. Overnight, the payroll service will implement your new settings.

- Enabling Multi-Location Payroll enables payroll at all locations, even locations that previously had it disabled. Since Multi-Location Payroll requires that all locations be on the same payroll frequency, all locations “inherit” the Payroll Main settings configured in Central Office.

- If a location was already running payroll when Multi-Location Payroll was enabled, Meevo truncates the location’s current payroll period at the appropriate date so that the location can take on the frequency and settings that were configured in Central Office.

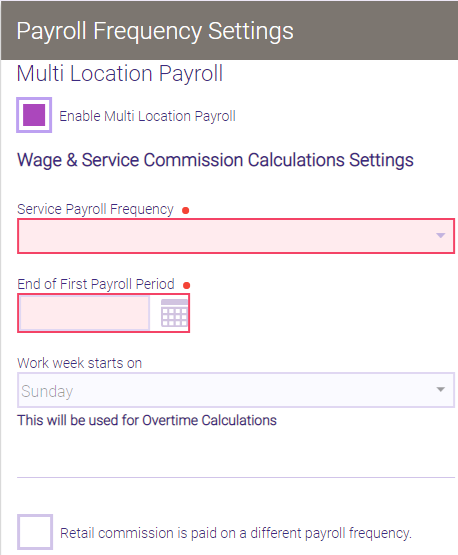

To enable and configure Multi-Location Payroll

Multi-Location Payroll is enabled and configured from the Payroll Settings screen in Central Office. From there, after selecting Enable Multi-Location Payroll, you’ll configure Payroll frequency using the same options you’re accustomed to seeing at individual locations. Just like with regular Payroll, a service that runs overnight will apply your payroll options.

Multi-Location Payroll Calculations

These sections explain how wages, salary, and commission are calculated for Multi-Location Payroll employees:

Settings at the employee's Home Location

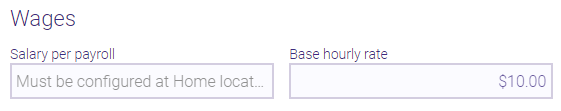

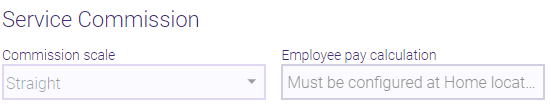

The following settings can only be configured at the employee's Home Location via the Payroll tab of their profile:

- Under the Wages section, Salary per payroll. Below is what you'll see if viewing the Payroll tab from a non-Home Location.

- Under the Service Commission section, Employee pay calculation. Below is what you'll see if viewing the Payroll tab from a non-Home Location.

Hours and overtime

An employee's overtime settings, including the overtime threshold, are configured at the employee's Home Location in Payroll Settings > Commission Detail. However, total hours for the week (in the context of determining whether an employee is eligible for overtime) are calculated across all locations. So, if an employee works 43 hours between three different locations and the OT threshold at the employee's Home Location is 40 hours, the payroll calculations would include 3 hours of OT at the Home Location, but no OT anywhere else.

Note: Holidays are also set from the Home Location.

Hourly Wage

- To determine hourly pay across multiple locations and Work Activities, Meevo uses a blended rate to calculate total hourly earnings. The blended rate calculation divides the sum of each Work Activity's earnings by the total number of hours worked across all locations during the work week.

[(Work Activity A hours x Work Activity A rate) + (Work Activity B hours x Work Activity B rate) + (Work Activity C hours x Work Activity C rate)] / (Work Activity A hours + Work Activity B hours + Work Activity C hours)

For example, let's say a Multi-Location Payroll employee worked the following hours:

Location A Work Activity: 16 hrs @ $12.50/hr = $200

Location B Work Activity: 20 hrs @ $20/hr = $400

Location C Work Activity: 20 hrs @ $15/hr = $300

The blended rate would be calculated as:

($200+ $400 + $300) / 56 hrs = $16.07 blended rate - Meevo then multiplies the blended rate by the number of total regular hours worked and total overtime hours worked (according to the threshold and multiplier defined in the employee's Home Location). Let's assume the Home Location's overtime threshold is 40 and the multiplier is set to 1.5.

- Regular hours: 40 hours regular time x $16.07 = $642.80

- Overtime hours: ($16.07 x 1.5 multiplier) x 16 hours overtime = $385.68

- Total earnings for the week: $642.80 regular pay + $385.68 overtime pay = $1028.48 earnings

Salary

An employee's Salary is defined in their profile within their Home Location. Note that the employee's Salary is not multiplied by the number of locations. Note employee Salary does not get multiplied by the number of locations.

Commission

Commission is calculated per location (honoring each location's settings, commission scales, etc.), Then the employee's commission from each location is added together to determine the employee's total commission amount.

Determining Employee Compensation

The Employee pay calculation field in the employee's Home Location determines how employees are compensated:

- Commission Only: Only commission gets paid out to the employee based on the above Commission calculations.

- Salary/Hourly Wage AND Commission: Meevo calculates the Hourly Wage based on the above calculations and compares that to the employee's Salary at their Home Location. The higher of those two values is then added to the employee's total Commission to determine the employee's total pay.

- Salary/Hourly Wage OR Commission: Meevo calculates the Hourly Wage based on the above calculations and compares that to the employee's Salary at their Home Location. The higher of those two values is then compared against the employee's total Commission. The higher of those two values determines the employee's pay.

Viewing Payroll

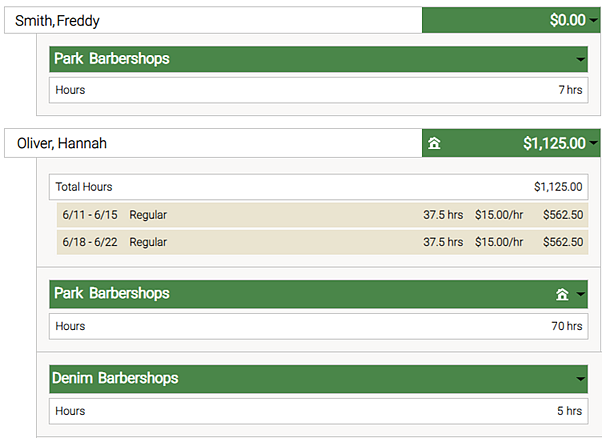

From a location’s Payroll screen, you can view hours for all employees who worked there during the payroll period. Note that only an employee's Home Location Payroll screen will calculate actual pay amounts; non-Home Locations only display the employee's hours.

Below is an example of how the Payroll screen might look when Multi-Location Payroll is enabled at fictional location Park Barbershops:

- Freddy Smith worked 7 hours at Park Barbershops. Park isn’t Freddy’s home location, so there is no Home icon in that row. Also, since only the Home Location pays out to the employee, Payroll does not display a pay breakdown or total amount for Freddy. That information is available in Freddy’s Home Location.

- Hannah worked 70 hours at her Home Location, Park, and 5 additional hours at their sister location, Denim. Since this is Hannah’s Home Location, her total hours and pay amount are calculated on the Payroll screen and encompass hours worked and wages earned at all locations.

Payroll Conflicts

If an employee has a payroll conflict at one location, the employee will appear with a payroll conflict in all relevant locations as well. A conflict is indicated by a yellow status.

Reprocessing Payroll

When you reprocess payroll, multi-location employees will be reprocessed at all locations. For example, if Matt worked at Locations A, B, and C, and Location B reprocessed Matt's payroll, his payroll data for that payroll period would be reprocessed at Locations A and C as well.

Disabling Multi-Location Payroll

Disabling Multi-Location Payroll gives payroll control back to each location. Location payrolls are not turned off; they continue with the same frequency that they used for Multi-Location Payroll, only now each location has the ability to edit their Payroll Settings as they like.