Configuring Payroll

If you haven't already, review our Getting Started with Payroll topic for important details before you proceed with setting up payroll in Meevo.

Note: Be sure to check out this topic on Multi-Location Payroll if you intend on running payroll for multiple locations.

About this workflow

The steps below outline a "best practice workflow" for setting up Payroll; it will get you up and running on Meevo Payroll quickly by walking you through the most common options and directing you to the more advanced options after standard setup is complete.

You'll first take care of hourly employee overtime and time clock settings, then employee wage and commission settings, and finally you'll move on to your business-level settings, such as payroll frequency. Configuring Payroll in this order will allow you sufficient time to explore the different options and configurations before queuing up the Payroll service.

Please note that it is not imperative that you configure payroll in this order; most of these settings can be configured at any time.

To configure Payroll

- Set Up Overtime

Define the overtime threshold and the overtime rate paid out to employees. If you do not have any hourly employees working at your business, you can skip this step. - Set Up Clock Rules

Restrict or grant access to Meevo based on employees' scheduled start times and clock-in times. If you do not have any hourly employees working at your business, or if you do not intend on using the Time Clock, you can skip this step. - Set Up Employee Earnings

From an employee profile's Payroll tab, you will define their pay type (hourly or salary) and rates, as well as the employee's commission for service, retail, membership, and package sales. You can also define commission based on the retail-to-service ratio. - Set Up Payroll Deductions

Deductions include Shop Costs, Labor Costs, and expenses associated with obtaining new clients. Deductions can be subtracted before or after commission is calculated. Deductions are optional and are not required for payroll. - After completing the steps above, you are ready to configure your business-level payroll settings.

- Type payrollsettings into the Convobar, or go to Meevo > Business Settings > Payroll Settings. Then select the Main tab.

Note: If payroll is already enabled, your current payroll settings appear here. If payroll is not enabled, a message at the top of the screen informs you of this.

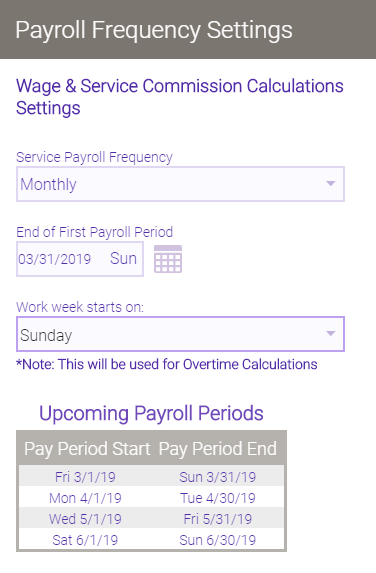

- Select Configure Payroll. The Payroll Frequency Settings slideout appears.

Note: If you are changing existing payroll settings, the current payroll's settings appear below each option for reference.

- Service Payroll Frequency: This determines how often a payroll is calculated for wages/service commission and retail commission. You can select Retail commission is paid on a different payroll frequency at the bottom of the window to set a different frequency for retail commission.

- Bi-Weekly: Payroll is calculated every two weeks for each employee, beginning on the work week start day.

- Custom Monthly: Payroll is calculated on a specific day each month according to what you selected as your End of First Payroll Period. Use this frequency if you want to pay your employees monthly, but on a day other than the last day of the month.

- Custom Semi-Monthly: Payroll is calculated twice per month for each employee on a custom twice-per-month frequency, meaning a cadence other than a standard Semi-Monthly cadence.

- Four Week: Payroll is calculated every four weeks for each employee. The payroll start date is determined by counting back four weeks from the End of First Payroll Period, and then subsequent payrolls are calculated every four weeks going forward from the start date.

- Monthly: Payroll is calculated each month for each employee, beginning on the first day of the month and ending on the last day of the month.

- Semi-Monthly: Payroll is calculated twice per month for each employee; there is a payroll period from 1st of the month to the 15th, and then a payroll period from the 16th to the last day of the month.

- Weekly: Payroll is calculated each week for each employee, beginning on the work week start day.

- End of First Payroll Period: Select the end date of your first payroll period. Depending on what you selected in the frequency setting, only certain dates may be available to you in the calendar. For example, if you selected Monthly, only the last day of the month is available because monthly payrolls always end on the last day of each month.

- Work week starts on: Meevo uses this field when calculating overtime. If you selected Bi-Weekly, Weekly, or Four Week payroll frequency, this field is automatically determined (and not editable) after you select the End of First Payroll Period date. If you selected Monthly or Semi-Monthly/Custom Semi-Monthly payrolls, you can select the day that the work week begins on.

- Retail commission is paid on a different payroll frequency: Select this option to reveal a Retail Payroll Frequency drop-down, where you can configure a separate payroll frequency for retail commission. If this option is not enabled, retail and service commissions are calculated together based on the Service Payroll Frequency.

Note: Retail Payroll Frequency offers an additional option, Quarterly, which pays out retail commission on the last day of every third month.

- As you define your settings, Meevo automatically generates a table of the next four pay periods. This helps illustrate how your selections impact the payroll dates. As you make changes to settings, the dates in these tables may also change.

- When finished setting up payroll frequency, select Save.

- A confirmation window appears, summarizing your payroll settings. Review this window carefully, and when ready, select Confirm.

- On the Main tab, there is now a Payroll Schedule Changed block.

- If your payroll is off, you can edit these payroll settings up until the night before the Pay Period Start date. So for the screenshot in step 12, you can make changes to these settings up until the night of February 28, 2019 (the night before the start of the first payroll period).

- If you are editing settings for existing payroll that is already on, you have until midnight of the current day to make changes. Overnight, the payroll service will implement your new settings.

- Your payroll is configured and ready to run! If needed, you can review the Advanced payroll options below for even more refinement of your payroll, including commission adjustments and overrides.

Advanced payroll options

After completing the standard payroll setup, you can explore the advanced payroll options offered by Meevo. Select a link to jump directly to that topic.

- Commission adjustments and splits: Define adjustments for specific appointment types such as requests and redos, manage spiffs, and pre-configure commission split ratios that you can quickly apply in the register.

- Commission overrides: Define commission for a specific service, product, package, or membership, or configure employee-specific commission overrides.

- Work Activity Overrides: Define the pay rate for when a specific employee is working a specific Work Activity. This rate overrides the employee's regular hourly pay rate.