Viewing or Changing CC/ACH Payment Information

Note: ACH payments are not currently available with MeevoPay.

Where can credit cards on file be added in Meevo?

Important: Do not use the Apple Pay payment method to capture cards on file. Cards on file captured via Apple Pay cannot be checked out in the register, as Apple does not store any actual card data.

Payment methods stored in the client profile are separate from payment methods stored in Membership Manager. Removing a payment method from one area does not remove it from the other. However, membership cards on file can be selected in the register if the client is paying via Card on File.

- Adding a card to a client profile allows the client to use that card for general purchases at the register. Those cards can be found in the Credit Card tab of the client's profile.

- Memberships with recurring fees require a client membership card on file. This can be done through the register at time of sale, or via the CC/ACH tab of Membership Manager (which is where membership cards on file are stored).

- Payment Plans also require a credit card on file which must be associated with the Payment Plan at the time of sale.

Can Meevo automatically add a card on file?

There are several ways that a client card on file can get added to Meevo:

- If the Paying Client in the Appointment Editor does not have a credit card on file, Meevo can display a prompt for the user to add one. For this prompt to appear, the Business Preferences setting Prompt for card on file when booking appointments must be enabled, and the Meevo user booking the appointment must have Grant access to the Data > Client > Credit Cards security key.

- When a client is using Self-Pay, they can choose to securely store their credit card for future use.

- If Credit Card Required is enabled in Online Booking Settings, the card will be saved to the client profile (as long as the Merchant Account being used supports this ability).

Does Meevo store client credit card information?

No, Meevo never actually "sees" or stores a client's entire card number. Client card data is handled by your credit card processor; Meevo only stores a token for the card along with supplementary info like the expiration date and last four digits of the card. As a result, your business can have client cards on file without the liability of storing and protecting personally identifiable information. Worldpay customers should refer to Refreshing a Worldpay Card On File Token for important information on tokens.

Note: For ACH payment methods, Meevo stores the full Bank Routing # and Bank Account #.

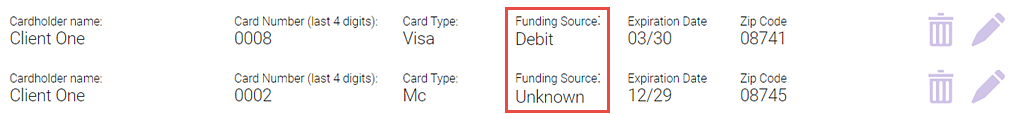

What does the Funding Source field mean?

MeevoPay captures a card's Funding Source to help you get a complete picture of what the card is and whether it is eligible for surcharges (if surcharges are enabled). Funding sources can be Credit, Debit, Prepaid, Unknown (if no funding source was captured by MeevoPay), or Not Captured (for cards on file that were added using a non-MeevoPay Merchant Account).

How are cards on file deleted from Meevo?

There are three ways a card on file can be deleted from Meevo:

- Client profile cards on file and membership cards on file can both be manually deleted from Meevo. When a deletion occurs, Meevo notifies the Merchant Account provider and the stored token is deleted from Meevo and the merchant's records.

- Meevo will automatically delete a token under the following conditions:

- Card on File (client's profile): If a card on file remains expired for 4 months (120 days) from its date of expiration, Meevo will automatically delete those cards and their tokens via a service that runs each evening.

- Membership Card on File (Membership Manager): For membership cards on file, Meevo first identifies all memberships that have been terminated or expired for 4 months (120 days) or more, and then Meevo removes the membership credit card's token from each of those memberships.

- A Business Information > Preferences option enables additional purging of cards based on the card activity at the business.

What happens if a payment attempt fails?

Network or communication issues:

If a payment attempt fails due to a network or communication issue:

- The payment status will immediately change to Error.

- The next day, the billing engine will automatically retry the primary payment method. If that attempt fails, the billing engine will make a third attempt on the third day.

- If all three payment attempts fail, then the membership status is updated to Suspended. The billing engine will attempt to process all outstanding payments on the next scheduled EFT date.

Reminder: If there are multiple payments due on the same date, the billing engine will combine them into one transaction to reduce processing fees.

Declined / Expired / Over Limit credit cards:

If a primary payment method is declined:

- The secondary payment method, if any, is attempted immediately.

- If the secondary payment method is declined – or, if there is no secondary payment method on file at all – the payment and the client's membership status are updated to Suspended. The billing engine will attempt to process all outstanding payments on the next scheduled EFT date.

Reminder: If there are multiple payments due on the same date, the billing engine will combine them into one transaction to reduce processing fees.

Can I view payment information for memberships that are no longer active?

Yes; Meevo stores the payment information described above for all memberships in the client's history. This includes Active, Not Active, canceled, and Expired memberships.

To view or change CC/ACH Payment Information

Worldpay customers can refer to Refreshing a Worldpay Card On File Token for details on the Refresh button.

- Locate the client in Membership Manager.

- Select the CC/ACH tab.

- Select a membership to view from the drop-down. The client's payment method details for that membership appear.

- Select Edit to edit these details.

Note: Worldpay customers can refer to Refreshing a Worldpay Card On File Token for details on the Refresh button.

- Edit details in Payment Information as needed. Note the following:

- If you change to a new payment method and save the form, the original payment information is removed from the form.

- Switching between Checking and Savings does not remove or reset the payment information.

- Change the Credit Card Terminal, if necessary, if you want to swipe a client's card.

- If desired, you can Add a Secondary Form of Payment. Meevo bills the secondary payment method if an error occurs with the primary method of payment.

- When finished, select Save.