Setting Up Payroll Overtime

Be sure to review our Getting Started with Payroll topic before you proceed with setting up overtime in Meevo.

How does Payroll calculate overtime?

Overtime is calculated each week according to your selections in the options shown below. Take note that payroll frequency is not considered in overtime calculations.

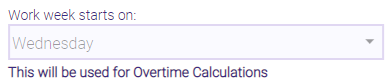

- The Work week starts on date, configured in Payroll > Main

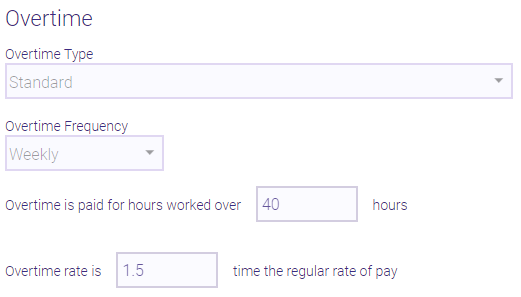

- Overtime settings in the Payroll Commission Detail tab, where you define the overtime threshold, frequency, and rate multiplier

Using the screens above as an example, the Work week starts on is set to Wednesday, and Overtime is paid for hours worked over 40 hours at a rate of 1.5 their regular pay. So, an employee who worked 45 hours between Wednesday and the following Tuesday will receive 5 hours of overtime pay at 1.5 times their regular rate. On the following Wednesday, weekly hours start over again and the employee must work another 40 hours that week before they are eligible for overtime.

Note: Overtime pay is calculated differently if an hourly employee has Work Activities with at least two different rates in the same payroll period. Be sure to check our FAQ on blended rates for details.

I am running a Semi-Monthly Payroll. How is overtime paid out if my work week overlaps with two different payroll periods?

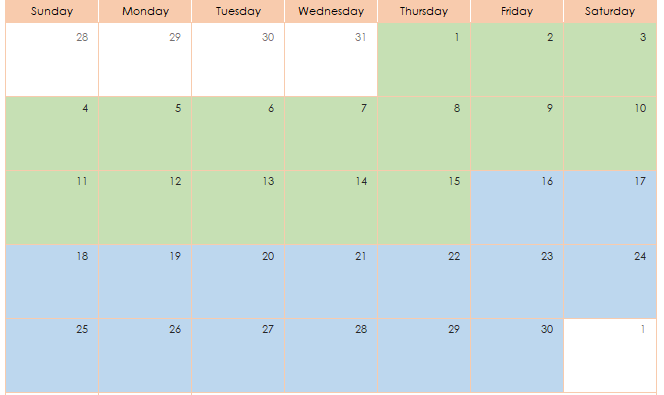

In the case of Semi-Monthly payrolls, it is possible for one payroll period to end and another to begin during the same week. In the calendar below, Payroll Period 1 is represented in green, while Payroll Period 2 is represented in blue. In this example, Payroll Period 1 ends on a Thursday and Payroll Period 2 begins on a Friday. Let's assume the work week start day is Sunday.

Since employee overtime cannot be calculated until the end of the week, and Meevo cannot assume or predict the hours that will be worked, overtime pay for the week in question will be calculated and included in the next pay period.

Using the above calendar as an example, at the end of Payroll Period 1, the employee will receive:

- Their regular pay for the 1st through the 15th.

- Overtime pay for the 28th through the 3rd, and overtime pay for the 4th through the 10th.

- No overtime pay for the week of the 11th, as that will be paid out in the next pay period.

At the end of Payroll Period 2, the employee will receive:

- Their regular pay for the 16th through the 30th.

- Overtime pay for the 11th through the 17th, and overtime pay for the 18th through the 24th.

- No overtime pay for the week of the 25th, as that will be paid out in the next pay period.

Note for Monthly and Semi-Monthly payroll frequencies: Though you may see dates from the preceding week in payroll calculations, employee pay is based on hours in the current pay period.

To set up overtime options

To get here, type payrollsettings into the Convobar, or go to Meevo > Business Settings > Payroll Settings. Then select the Commission Detail tab.

Note: Holiday hours (from the Holiday screen or a Work Activity) will never count towards overtime.

- Overtime Type: Determines how overtime is calculated for employees.

- Standard: By far the most common overtime type, this allows you to create your own overtime calculations through the additional options explained in the steps below.

- Advanced: Overtime calculations are much more involved, and are usually reliant on your country or state's overtime laws. Selecting this type reveals options for defining the various multipliers that go into advanced overtime.

- Overtime Frequency: Determines when overtime is calculated (Daily or Weekly). This option works in conjunction with the options below to determine how overtime is paid. Weekly overtime is the most common frequency.

- Overtime is paid for hours worked over ___ hours: Determines when overtime calculations begin. For example, a Daily frequency with a threshold of 8 means that anything over an 8 hour workday is considered overtime. A Weekly frequency with a threshold of 40 means that anything over a 40 hour workweek is considered overtime.

- Overtime rate is ___ time the regular rate of pay: The value an employee's hourly rate should be multiplied by this value to calculate overtime. This applies to hourly employees. Time-and-a-half (1.5) is a common overtime rate.