Setting Up Service-Level Deductions

Be sure to review our Understanding Deductions topic before you proceed with setting up deductions in Meevo.

Service-level deductions are standard amounts or percentages that are deducted from the commission of any employee who performs that service and who has the corresponding deduction enabled in their profile.

Note: Deductions are not applied to flat rate commission overrides. For example, if a service has a $15 flat commission override with a $2 Shop Cost Deduction, the $2 deduction will not be applied and the employee will still receive $15 each time that service is performed.

- Locate the service and select the Payroll tab, and then select Edit.

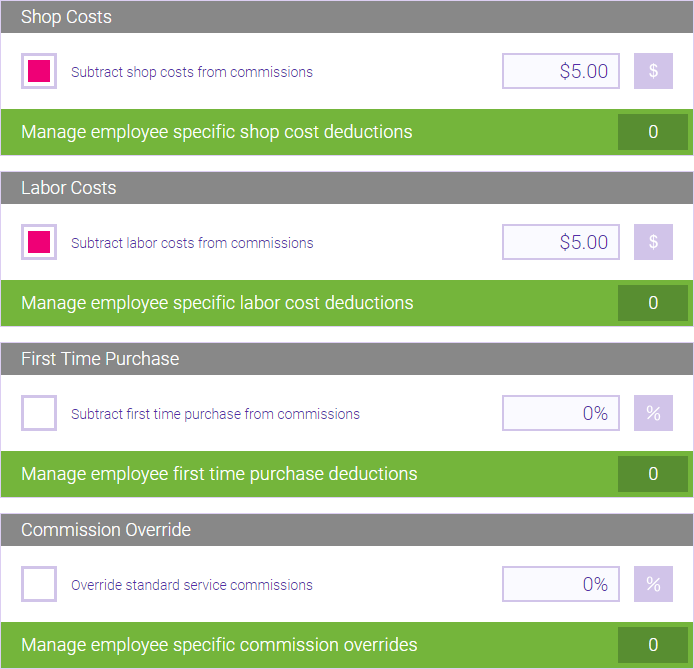

- Set up your deductions. The green Manage employee ___ deductions buttons on this screen are an alternative way to set up employee-level deductions. The Manage employee specific commission overrides button is an alternative way to set up commission overrides for individual employees.

Note: Employee deduction calculations can be impacted if commission on an item is split between two employees. See the Splitting Commissions topic for details.

- Shop Costs: Shop costs may include product and equipment usage. Select $ or % to toggle between the two units, and enter a value.

- Labor Costs: Labor costs may include assistants and similar staff. Select $ or % to toggle between the two units, and enter a value.

- First time Purchase Deduction: First time purchase deductions help offset marketing and advertising costs that are associated with obtaining new clients. The First Time Purchase Deduction is applied if it is the first time an employee is performing this service on this client within this location. Select $ or % to toggle between the two units, and enter a value. Note that the first-time purchase deduction is calculated overnight, not in real-time.

- Ben performs a haircut on Tanya in Location A, and it is the first time Ben has ever performed this service on Tanya. Ben will incur a First Time Purchase Deduction.

- Four weeks later, Ben performs that same haircut on Tanya in Location A. Ben will not incur a First Time Purchase Deduction, as that charge was incurred in a above.

- Five weeks later, Ben, who is a multi-location employee, performs that same haircut on Tanya, but at a different location. Ben will incur a First Time Purchase Deduction, as this is the first time he's performed that service on Tanya at that location.

- Five weeks later, Ben performs a haircut and color on Tanya in Location A, and it is the first time Ben has ever performed a color on Tanya. Ben will incur a First Time Purchase Deduction for the color, but not the haircut, as the haircut charge was incurred in a above.

- Override standard service commissions: This option overrides any employee's standard commission when this service is performed; see Setting Up Commission Overrides for a Service for details.

- When finished, select Save.

- Finally, make sure you enable the deductions in each employee's profile for the deductions to take effect.