MeevoPay Surcharges

A surcharge, sometimes called a checkout fee or service fee, allows you to pass on a portion of your credit card processing fees to your customers. This can reduce business expenses and increase margins. Plus, a surcharge shows your customers the exact cost of using a credit card instead of other lower-cost payment methods like cash or debit cards.

With MeevoPay, you can apply a credit card processing fee (surcharge) to transactions; the fee will be a percentage of the transaction total that you can configure in the Merchant Account definition. When surcharges are enabled, they get applied to transactions in the Meevo register, as well as during Self-Pay, Online Booking, Online Membership Sales (if the option is enabled in Online Membership Settings), and eGift transactions.

Note surcharges are not assessed on membership or Payment Plan EFTs that are auto-billed using a card on file.

Before you begin

Businesses who choose to surcharge must follow all regulations according to their country, state, and the card brand being surcharged. Here are some general things to be aware of:

- It's important to note that the implementation of credit card surcharging is subject to various regulations and guidelines that vary by region and payment network. Businesses considering surcharging should carefully review these regulations and consider the potential impact on customer relationships before implementing such policies. Additionally, clear communication with customers about surcharging is essential to maintain transparency and trust.

- Businesses in the U.S. can configure a maximum of 4% for a given Payment Type. However, since surcharge regulations can vary by country, state, and card brand, it is your business's responsibility to know those regulations and set the proper percentages for each card. You should know all of this information prior to enabling surcharges.

- For example, in the United States, Visa allows a maximum of 3%, while MasterCard and Discover allow up to 4%. But in Canada, surcharges cannot exceed 2.4% for any card brand. Note these surcharge percentages are accurate as of April 2024.

- After enabling surcharges, Meevo displays a warning message as a reminder of your responsibility: "By choosing to Surcharge, you implicitly agree to follow all rules and requirements put forth by card issuers and all regulations enforced by your state. We strongly recommend reading through our help topic and its references before turning on Surcharges. Do you want to continue with Surcharges enabled?"

Setting up surcharges in Meevo

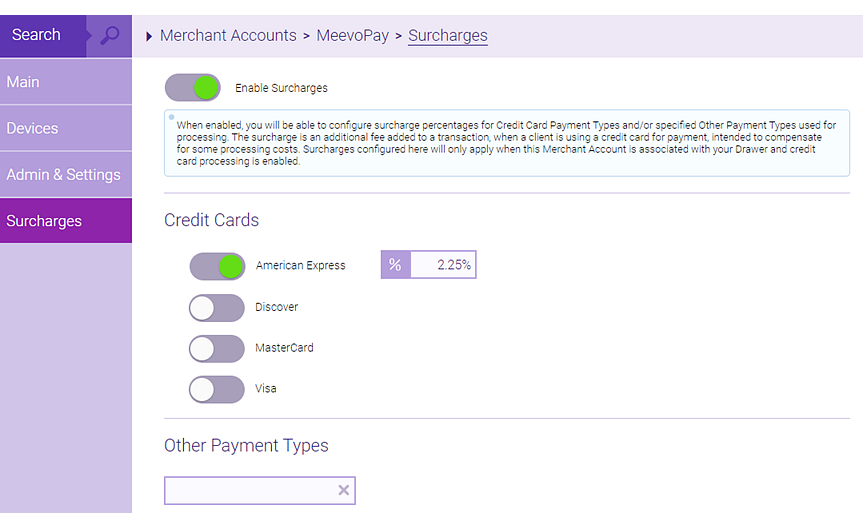

- Enable and configure surcharges from the new Surcharges tab on a MeevoPay Merchant Account definition.

- Surcharges can be applied to American Express, Discover, MasterCard, and Visa credit card Payment Types.

- Surcharges can also be applied to custom "Other Payment Types" (alternative methods of payment that your business accepts, like PayPal or Venmo).

- Surcharges never get applied to debit or prepaid gift card Payment Types.

Tip: MeevoPay captures a card's Funding Source to help you get a complete picture of what the card is and whether it is eligible for surcharges (if surcharges are enabled). Check out the card details in a "Card on File" tab or a transaction's Merchant Receipt to view a card's Funding Source.

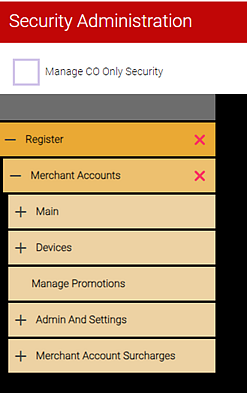

Securing the "Surcharge" tab

Secure the surcharges tab on the Merchant Account screen via the Register > Merchant Accounts > Merchant Account Surcharges keys and sub-keys.

Applying surcharges

Meevo automatically applies surcharges as described here:

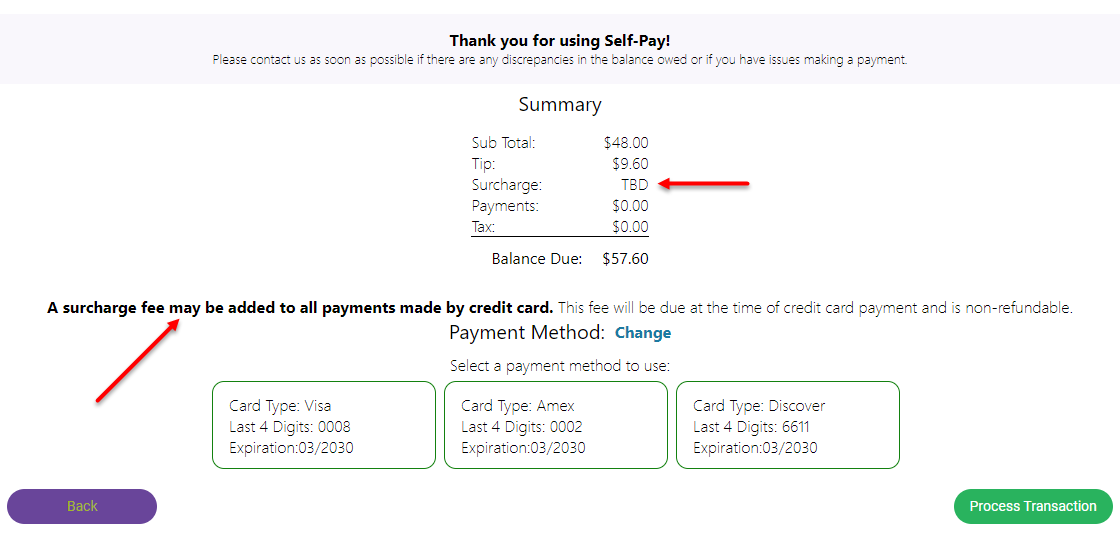

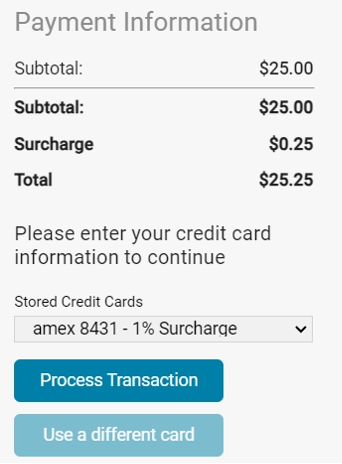

Surcharges in Self-Pay

When surcharges are enabled on a MeevoPay Merchant Account, Meevo automatically calculates and adds the surcharge to the Self-Pay total based on the card being used to pay for the transaction. A Surcharge field on the Summary page informs clients of the fee along with a note above the Payment Method field.

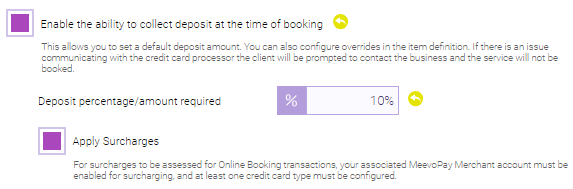

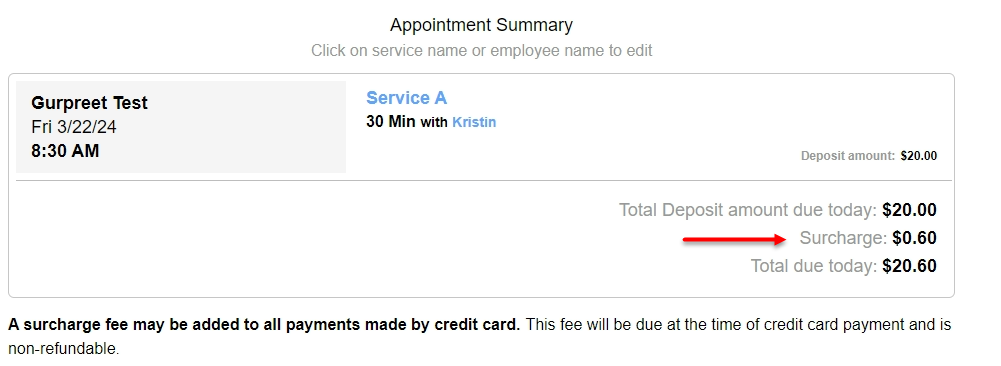

Surcharges in Online Booking

- To apply surcharges to Online Booking deposits, you'll need to enable the surcharge option in Online Booking Settings.

- When you enable surcharges on your MeevoPay Merchant Account, an Apply Surcharges sub-option will appear below Enable the ability to collect deposit at the time of booking in Online Booking Settings. Apply Surcharges is enabled by default.

- In Online Booking, a Surcharge field on the Appointment Summary page informs clients of the fee along with a note below the total.

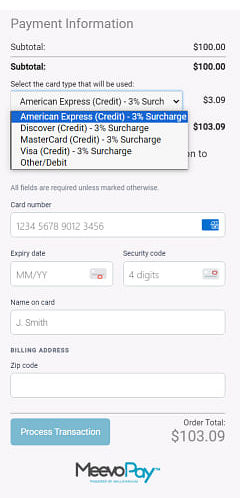

Surcharges in eGift

When you enable surcharges on a MeevoPay Merchant Account, Meevo automatically calculates and adds the surcharge to the eGift total. Clients can see the surcharge percentage beside each payment type in the "Select a card" drop-down, and a Surcharge field in the Payment Information section informs clients of the fee amount once a card is selected.

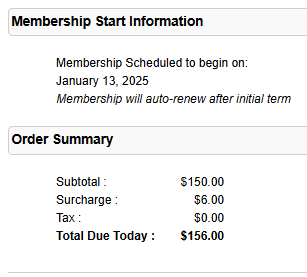

Surcharges in Online Membership Sales

When the Apply Surcharges option is enabled in Online Membership Settings, Meevo automatically calculates and adds the surcharge to the membership sale total. Clients can see the Surcharge field in the Order Summary section prior to submitting a payment.

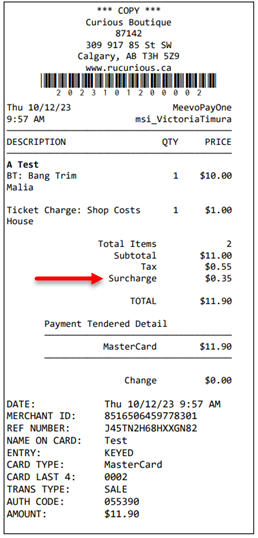

Surcharges on receipts

Surcharges are itemized on receipts. They appear as their own line item in the Smart Receipt, on printed receipts (below), and in the Transaction Editor.

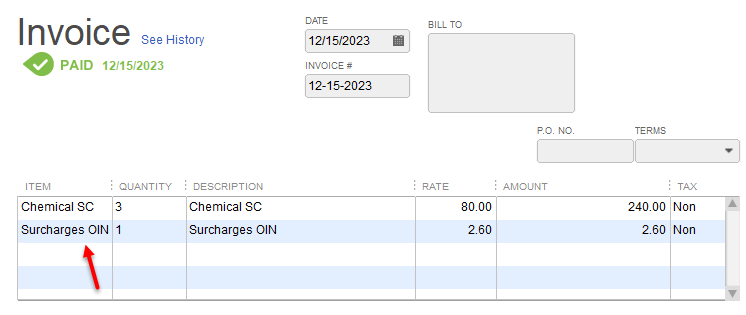

Surcharges in the Quickbooks Integration

Surcharges are recorded in a new Surcharges sub-account under the Meevo Other Income account. Within the invoice, it appears as Surcharges (OIN).

Refunding surcharges

If a transaction included a surcharge, you can refund the full amount back to the client as long as the corresponding Business Preferences setting Allow the refunding of surcharges on eligible transactions is enabled.

Reporting on surcharges

Surcharges appear in the following Meevo reports:

- MR080: Register Summary now includes a Surcharges field on the right side of the report, below the Tax Total.

- MR100: Transaction Log now includes a Surcharges line below the Tips line.

- MR110: Payment Detail and COMR110: Payment Detail (CO version) now include a new Surcharges column.

- CF001: Cash Flow now includes a new Surcharges Collected line in the Sales section.

Related Topics

- MeevoPay: Features and Benefits

- MeevoPay: Funding, Rates, and Fees

- MeevoPay: Details on Card Readers

- MeevoPay: Transactions and Refunds

- MeevoPay: Applying for a Merchant Account

- MeevoPay: Migrating Worldpay Tokens to MeevoPay

- MeevoPay: Merchant Account Setup

- MeevoPay: Reconciling Transactions and Chargebacks

- MeevoPay: Setting Up SpaFinder Gift Cards