MeevoPay Transactions and Refunds

Credit Card Transactions

Security for Card-on-File Payments

MeevoPay provides added protection when clients use a saved card for payments:

- Client Transactions (Online Booking, Self-Pay, eGift): Clients must re-enter their CVV to complete a payment when using a card on file. This extra step enhances security by verifying that the purchaser has access to the physical card.

- Front Desk Transactions (In-Store Checkout): Front Desk Employees can choose to require CVV re-entry when using a card on file, offering flexibility for front desk workflows.

- A Re-enter CVV to Validate checkbox is available within the Register's Cards on File area.

- Enabling this option reveals a Security Code field below the list of saved cards, which must be filled in to complete the transaction.

Pre-Authorization

- For any transaction over $1.00, MeevoPay performs a pre-authorization check.

- When adding a card on file, MeevoPay conducts a $0.00 pre-authorization to validate the card information.

Manual Entry Restrictions

Manually entering card numbers on a pinpad can increase the chance of chargebacks. To mitigate this, the Prompt for manual entry of credit card information on the device checkbox is not available when MeevoPay is the active Merchant Account.

Receipt Signatures

- Major credit card companies like Visa, Mastercard, American Express, and Discover have largely eliminated the requirement for cardholders to sign receipts or cards for transactions.

- This shift is due to advancements in technology and the widespread adoption of chip-enabled cards and EMV technology.

- While some merchants may still require signatures, especially for certain types of transactions, the overall trend is towards a signature-free experience.

Debit Card Transactions

Swiping a debit card usually brings the client right to the signature screen. However, a client will be brought to the "PIN" screen if:

- The debit card issuer requires a PIN, or

- The debit transaction is over $300, in which case a PIN is always required.

Note: On debit transactions, clients do not select the debit type (US Debit or VISA/MasterCard Debit). There is no cost advantage to one over the other, so this step does not appear on MeevoPay devices.

Transaction Details and Reporting

The MeevoXchange is where you can view totals, individual transactions, fees, and export MeevoPay batch details. MeevoPay fees are assessed daily before funds are deposited, so daily deposits are not likely to match the totals displayed on Meevo reports.

Important Details on Refunds

Unreferenced refunds

MeevoPay does not support unreferenced refunds. An unreferenced refund is a refund that is not linked to the original payment transaction.

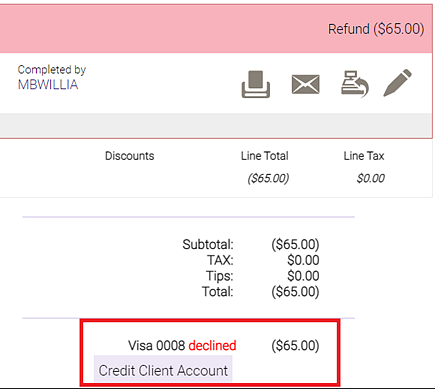

Declined refunds

In most cases, refunds to credit cards are processed instantly. In cases where a refund is not processed immediately, you can easily locate the transaction in Transaction Editor to verify it was declined, and then resolve the refund as you see fit.

- To locate a declined refund in Transaction Editor, select Advanced Filters and enable the checkbox Declined refund transactions. Applying this filter limits the results to declined credit card refunds processed through MeevoPay.

- Select a refund transaction to expand its details. Verify the status reads Declined. Declined refunds cannot be reprocessed, so in lieu of a refund we recommend providing account credits, points, or a gift card to the client for the amount of the refund.

Interac debit card refunds (Canadian businesses only)

Interac debit card refunds can only be processed on the same day as the original transaction.

- If a refund is required after the original transaction date, the cardholder must return to your location, in person, to complete an unreferenced (in-person) refund.

- Alternatively, the cardholder may choose to have a credit added to their account for future use instead.

Unfortunately, Interac does not support remote or 'Card Not Present' refunds once the transaction date has passed.

Please ensure your staff is aware of this limitation so they can properly set expectations with customers at the time of payment and when handling refund requests.

If you have any questions or need additional guidance, please contact us directly at (973) 402-8801 option 5 or MeevoPay_Support@meevo.com. Thank you for your patience and understanding.

Related Topics

- MeevoPay: Features and Benefits

- MeevoPay: Funding, Rates, and Fees

- MeevoPay: Details on Card Readers

- MeevoPay: Applying for a Merchant Account

- MeevoPay: Migrating Worldpay Tokens to MeevoPay

- MeevoPay: Merchant Account Setup

- MeevoPay: Surcharges

- MeevoPay: Reconciling Transactions and Chargebacks

- MeevoPay: HSA/FSA Accounts

- MeevoPay: Setting Up SpaFinder Gift Cards