MeevoPay: Reconciling Transactions and Chargebacks

Timing of Deposit and Transaction Details

The table below details the timing for deposits and their related transaction details.

|

Meevo Transaction Day |

MeevoPay Payout Deposit Day to Bank |

Xchange Deposit Summary | Xchange Deposit Details/Transaction Search |

| Monday | Tuesday | Wednesday | Wednesday / *Thursday |

| Tuesday | Wednesday | Thursday | Thursday / *Friday |

| Wednesday | Thursday | Friday | Friday / *Saturday |

| Thursday | Friday | Saturday | Saturday / *Sunday |

|

Friday & Saturday (combined) |

Monday | Tuesday | Tuesday/*Wednesday |

|

Sunday |

Monday | Tuesday | Tuesday / *Wednesday |

* In most cases, deposit and transaction details will be available the same day as the Xchange Deposit Summary. In rare cases, details may be delayed. When this happens, the Deposit Summary will still display on the scheduled day but will be marked as Pending until all details are finalized and accurate.

Viewing Deposit and Transaction Details in the MeevoXchange

Important: If you had an active MeevoPay Merchant Account when we upgraded the MeevoPay platform, you may have two Merchant IDs (MIDs) associated with your business. When accessing your data in MeevoXchange, make sure to select the correct Merchant Account ID from the Select Merchant Account ID drop-down (as shown in Step 3 below). This ensures you’re viewing the correct transaction and deposit information for your account.

To view details on MeevoPay batches and transactions:

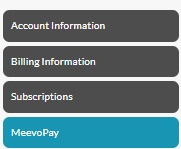

- In Meevo, go to Meevo > MeevoPay > MeevoPay Account Management to open the MeevoPay section of the MeevoXchange.

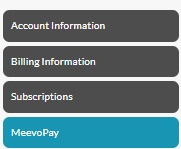

- On the left pane, select MeevoPay.

- If you have multiple MeevoPay Merchant Accounts, select an account from the Merchant ID field. If you only have one account, it will be the only available option.

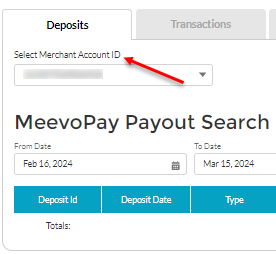

Deposits tab

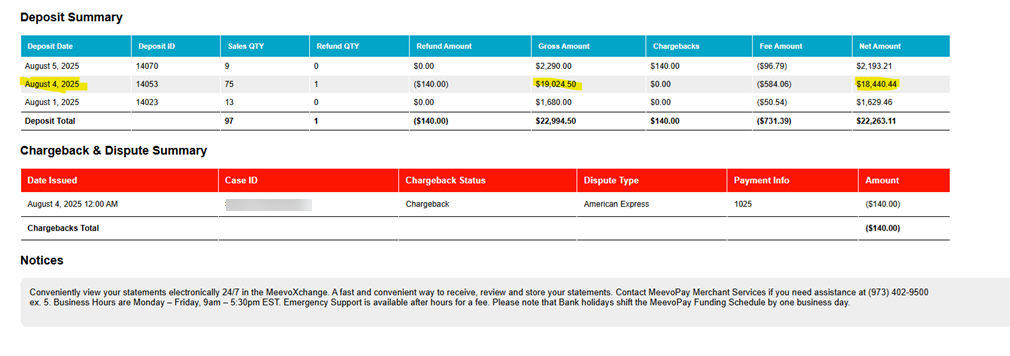

The Deposits tab shows payout details and lists the transactions within a deposit (batch).

- Batches that were deposited during the date range are listed by Deposit Id, otherwise known as the Batch Id.

- Fees are assessed before funds are deposited; the Net Amount deposited reflects any deducted fees.

- To view transactions within the batch, select the Deposit Id number. The list of transactions includes details like the transaction id, payment method, and the associated batch (Deposit Id) the transaction is a part of.

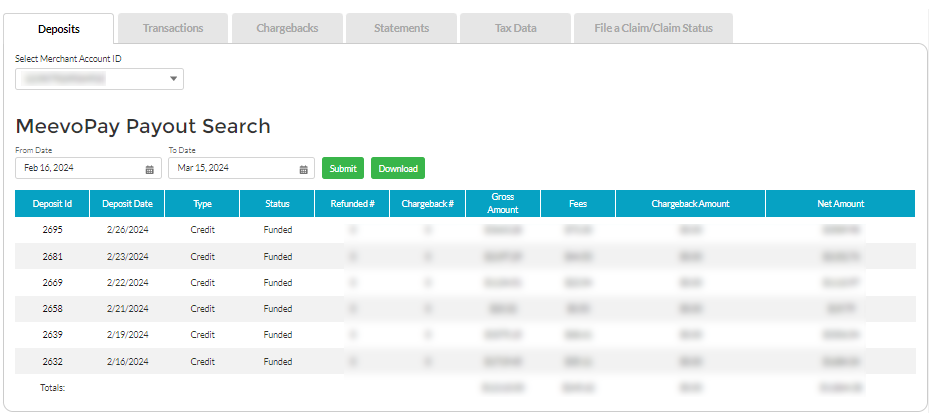

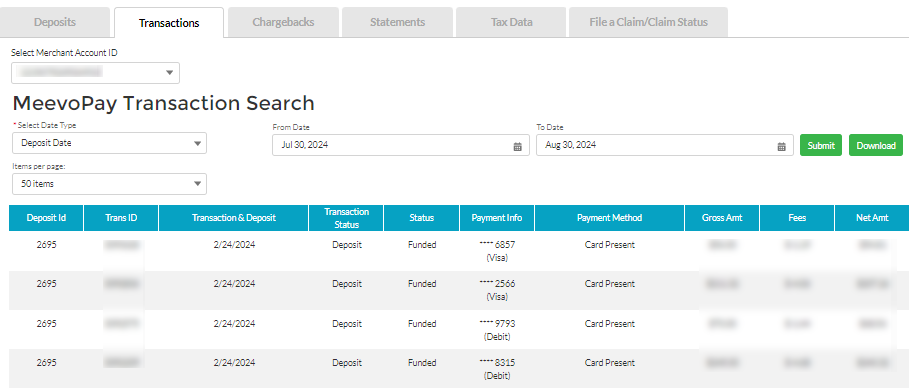

Transactions tab

The Transactions tab provides transactions within a date range based on the Deposit Date or Transaction Date. You can download batch transaction details directly from this tab and then use that exported data as a guide when reconciling.

- Declined transactions are not currently viewable through the MeevoXchange. For insight on declined cards (especially repeat declines), please reach out to us at (973) 402-9500 and select option 4.

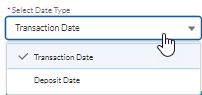

- If you are reconciling against Meevo reports, set the Date Type field to Transaction Date to list all transactions that occurred within the date range. Make sure to search the same date range in the Meevo report.

- Setting the Date Type to Deposit Date lists the transactions associated with batches that were deposited during the date range. For example, setting the From date to June 18th and the To date to June 19th will display all transactions from June 17th and 18th (since the deposit/funding dates were one day after the transaction dates).

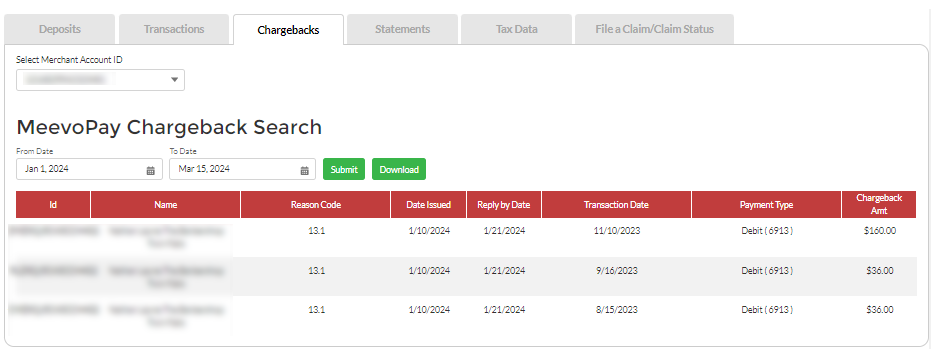

Chargebacks tab

The Chargebacks tab is where you can view details on chargebacks that were made against the Merchant Account.

- Chargebacks appear in the portal at the time of deposit/funding.

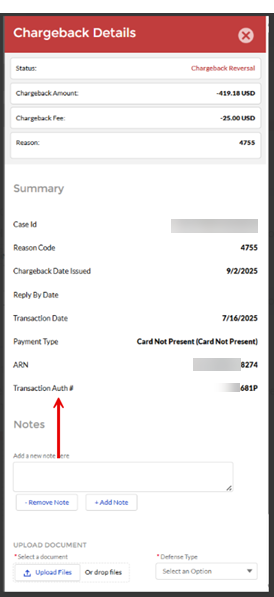

- As with the Transactions tab, you can select the Id to view a "details" modal that lists additional information about the chargeback.

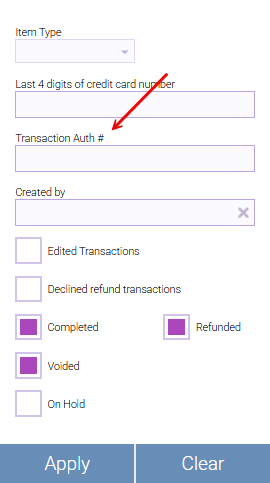

- The "details" modal displays the Transaction Auth #. Search by this code in the Meevo Transaction Editor to locate the original transaction.

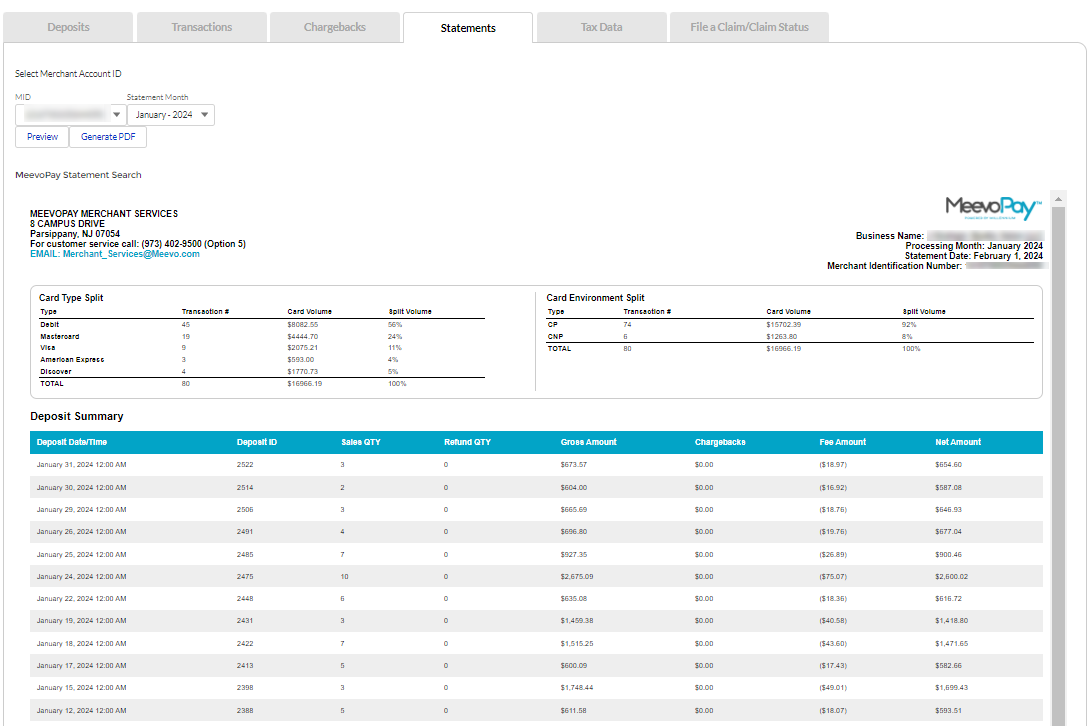

Statements

The Statements tab offers the ability to conveniently view your monthly statements electronically.

From this tab, you can:

- Generate PDFs of your statements for download.

- Review card type data as well as card present vs not present transaction data.

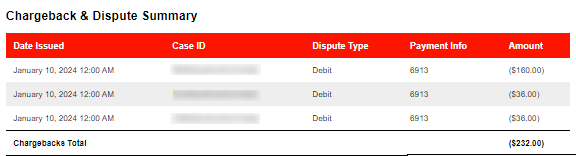

- Review the Chargeback & Dispute Summary from the previous month.

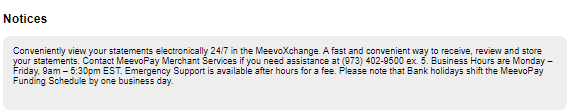

- Check the Notices section for important updates or upcoming changes to your MeevoPay account.

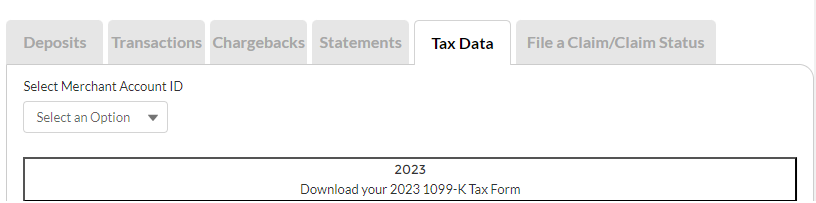

Tax Data

The Tax Data tab allows you to download your 1099-K Tax Form for the previous year. This tax form is available only to businesses who meet or exceed the $20,000 volume threshold and the minimum of 200 transactions.

Reconciling Chargebacks

Reconciling your transactions ensures that the deposits received from MeevoPay align with the sales data recorded in Meevo. This process verifies that all payments are accurate and that any chargebacks or adjustments are properly reflected.

Because MeevoPay fees are assessed daily—prior to deposit—your daily deposit amounts may not match the totals shown in Meevo reports. When reconciling, use the guidelines below to accurately compare your MeevoPay deposit data with Meevo’s sales reports:

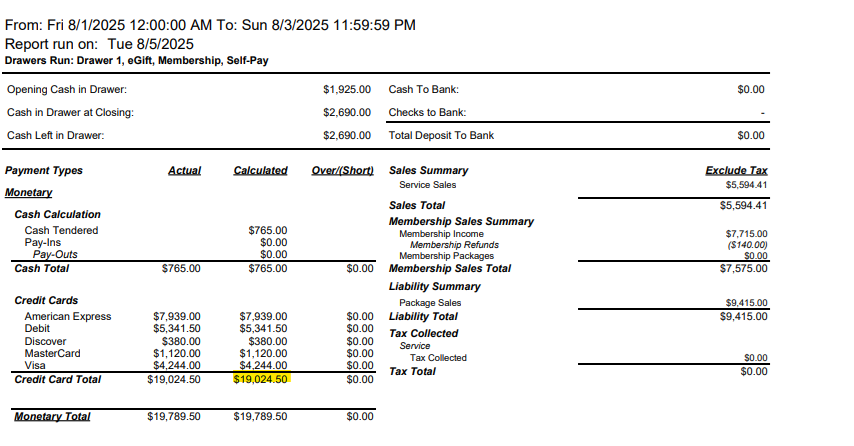

- Run the MR080 in "Detail Mode," choosing a date range that aligns with the date range of the deposit.

- In the MR080 output, take note of Credit Card Totals.

- Next, you'll want to review the deposit batch details in the MeevoXchange.

Note: Transaction details may not always be available on the same day as the deposit. Review the table Timing of Deposit and Transaction Details located in the beginning of this article for specific timings based on deposits.

- In Meevo, go to Meevo > MeevoPay > MeevoPay Account Management. On the left pane, select MeevoPay.

- Select the Deposits tab and be sure to scroll to the bottom of the page to review the Deposits Summary and Chargeback & Dispute Summary. In most cases, discrepancies between the MR080 and your Net Deposit Amount are explained by the information in these sections.

- You can also view the details of a specific deposit by selecting its Deposit Id. A summary row at the bottom of the modal provides your Total Gross Deposit Amount, Total Fees, and Total Net Deposit Amount.

- For transaction-by-transaction reconciliation, export a deposit's transaction details directly from the Transactions tab and compare that exported file to Meevo's MR110 run for the same date range.

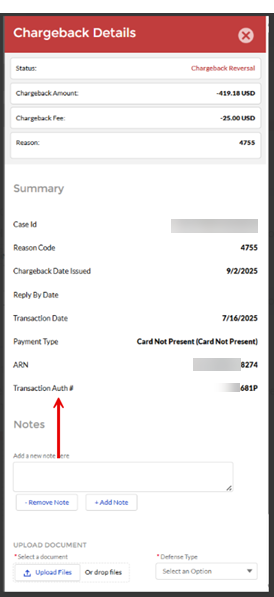

Locating the original transaction in Meevo

From the MeevoXchange, you can view additional chargeback details that help you identify the related transaction in Meevo:

- Go to the Chargebacks tab and locate the chargeback.

- Select the Id of the chargeback to open a Chargeback Details modal.

- Note the Transaction Auth # displayed in the modal.

- In Meevo, open Transaction Editor and perform an Advanced Search using that same Transaction Auth # to find the original transaction.

Filing a Claim

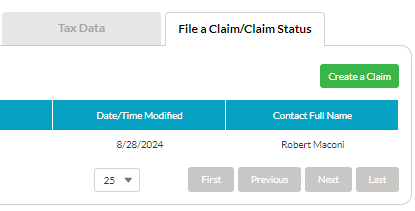

If your business bank account incurred fees as a direct result of a MeevoPay funding delay, you can submit a claim to cover those losses.

Details on filing a claim:

- The account must have incurred NSF fees and ACH Rejects as a direct result of a funding delay from MeevoPay. The claim does not apply to delays originating from the bank or institution.

- In the claim, submit (1) a screenshot from your bank account with the daily available balance right before the missed funding/deposit from MeevoPay, and (2) your account right after the day you should have received the deposit.

- Accounts that were already in a negative state (negative balance) prior to the funding issue on our end are not eligible for fee reimbursement.

Recommended closing reports

At a minimum, we strongly recommend running the MR100: Transaction Log daily or as needed to assist with closing out and reconciling the register, as it provides important data for all of your drawers including drawer totals, deposit amounts, sales, etc.

Aside from the MR100, the following can help with closing out at the end of the day:

- MR080: Register Summary

- MR085: Sales Detail

- MR110: Payment Detail

- MR115: Pay In/Out History

- MR240: Daily Deposit Report

- DE070: Tips Collected

Related Topics

- MeevoPay: Features and Benefits

- MeevoPay: Funding, Rates, and Fees

- MeevoPay: Details on Card Readers

- MeevoPay: Transactions and Refunds

- MeevoPay: Applying for a Merchant Account

- MeevoPay: Migrating Worldpay Tokens to MeevoPay

- MeevoPay: Merchant Account Setup

- MeevoPay: Surcharges

- MeevoPay: HSA/FSA Accounts

- MeevoPay: Setting Up SpaFinder Gift Cards